UK Property Market 2025: Predictions

- Rotas Investment

- 09 January 25

The UK housing market continues to maintain its strong position despite the challenging economic conditions in recent years. Predictions for 2025 suggest that house prices will continue to rise and present attractive opportunities for investors. Rising wages and falling interest rates are among the key factors supporting this growth.

.webp)

A Resilient Rise in the Housing Market

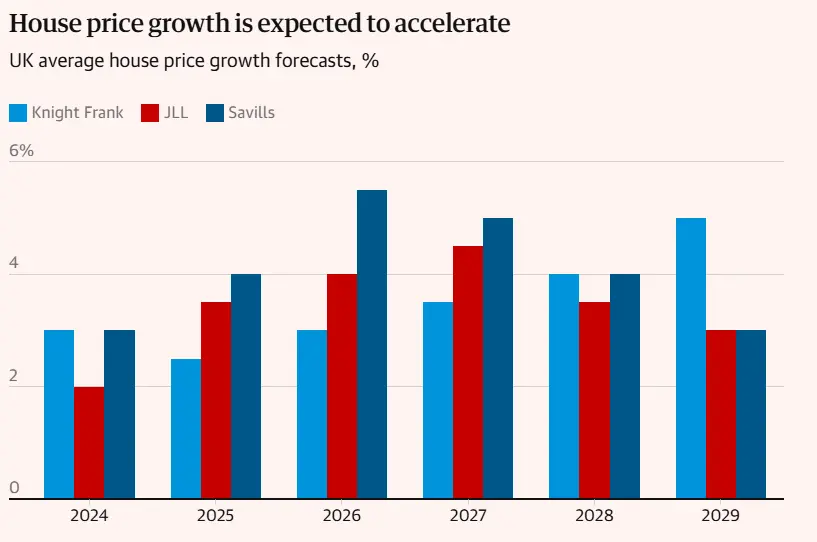

After a 1.4% decline in house prices in 2023, prices rose by more than 3% in 2024, defying expectations. Forecasts for 2025 indicate that this growth will continue, with an increase of between 2% and 4%. Outside of London, regional markets are expected to shine. According to Savills, property prices in northern regions such as Greater Manchester, Liverpool, and Yorkshire could increase by as much as 4.5%, driven by strong demand and ongoing redevelopment projects. By 2026, prices could accelerate further, reaching up to 5.5%.

This growth is largely influenced by strong wage growth and lower interest rates. In October 2024, wage growth stood at 5.2%. As mortgage rates decrease, activity in the housing market is picking up pace.

Developments in Mortgage Rates

In 2024, the Bank of England reduced interest rates twice, bringing them to 4.75%. In 2025, mortgage rates are expected to fall further to around 4%. This will reduce borrowing costs for homebuyers and allow them to secure mortgages on more favorable terms.

The drop in mortgage rates presents a significant opportunity for both first-time homebuyers and existing homeowners. However, these lower rates are expected to be temporary, so investors are advised to act quickly.

New Activity in the Housing Market

With falling interest rates, sales in the housing market are on the rise. The average price of a home in the UK is now around £300,000.

According to predictions from Nationwide, Halifax, and Knight Frank, house prices are expected to increase by 2% to 4% in 2025. According to Rightmove, demand from renters nearly doubled in 2024 compared to pre-pandemic levels, with an average of 19 requests per rental property. Rent prices across the UK rose by 9.1% in 2024, and in the last five years, rents have increased by 40%. However, in 2025, the rental market is expected to stabilize gradually, with rents seeing a growth of about 3%.

Opportunities for Investors in 2025

Real estate projects in major cities such as Birmingham, Manchester, and London offer high rental yields and potential for value appreciation. Due to changes in Stamp Duty (property tax), sales activity is expected to increase between January and March.

Time to Act

2025 could be the right time for real estate investment in the UK. The potential rise in property prices combined with the normalization of the rental market offers investors a dual opportunity for profit.

If you're interested in entering the UK housing market and would like detailed information, Rotas Investment is here to support you. Our expert team is with you every step of the way to help you achieve your goals.

Contact us today and let’s shape your future with a property investment in the UK!